Investment Process

Thought Leadership

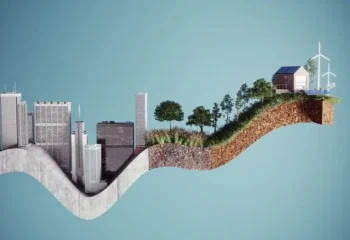

From Nihilism to Intention: Rethinking Investment Purpose

We’re pleased to share an insightful article by our President, Erika Karp, and CIO, Garvin Jabusch, originally published in Wharton Magazine, exploring a central challenge of our time: how capital deployment shapes the future of civilization. In “Beyond Nihilism: Funding the Next Economy,” they reframe the current financial paradigm — …Read More »

Electrons, Intelligence, and the Shape of the Next Economy™: 2025 Year-End Macro Commentary

By Garvin Jabusch The defining question of 2025 wasn’t whether artificial intelligence would transform the economy. It was whether intelligence alone would be enough. Silicon Valley spent the year betting everything on the proposition that whoever builds the most capable AI models wins the future. China made a different wager: …Read More »

The $7 Trillion Market Distortion: Why Capitalism’s Survival Depends on Ending Energy Subsidies

By Garvin Jabusch, Green Alpha Investments CO₂ emissions directly increase the amount of energy trapped in Earth’s atmosphere. This isn’t abstract—it’s physical reality. More emissions mean more energy retained. More energy means more extreme atmospheric behavior. Storms intensify, heatwaves extend, droughts deepen, flights experience more and worse turbulence. This first …Read More »